INSURANCE

Monitor Insurance Model Drift

Eliminate underwriting guesswork and manage model drift to increase profitability

Minimizing claims probability with machine learning models is imperative in modern underwriting. By leveraging ML observability when deploying insurance models, practitioners can accurately determine reserves, increase profitability projections, and ensure model transparency for regulators.

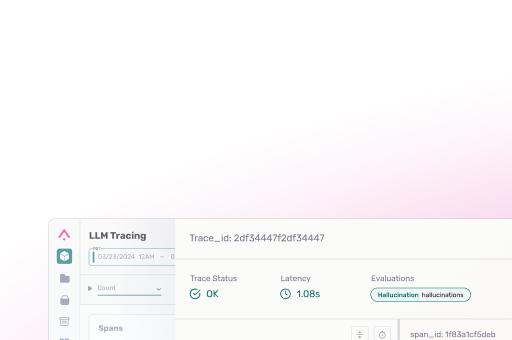

See how Arize can help you manage delayed ground truth scenarios with drift monitoring. Monitor for feature, prediction, and actuals drift against a set baseline to trigger automatic alerts and guardrail your model from potential volatility. Dive deep into root causes and quickly gain intuitions to iterate, experiment, and ship new models in production.

Visualize drift between various model environments and versions to identify claims patterns

Clearly understand drift impact with drift over time widgets overlaid with your metric of choice

Analyze data drift at a granular level for future financial projections